No one wants to work forever, and taking full advantage of the 401(k) Savings Plan is one of the ways you can ensure you won’t have to. Learn more about the many benefits this plan provides, including money from Synopsys, tax savings, and a choice of investment options that allows you to create your own personalized investment strategy.

What’s in It for You

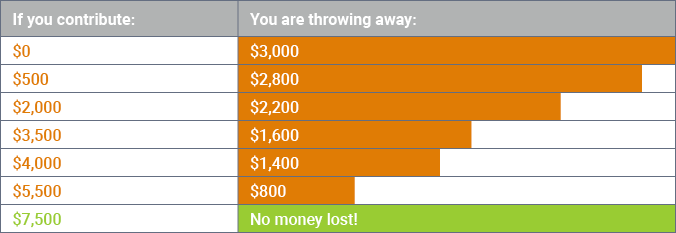

- Free money from Synopsys! Synopsys matches $0.40 for every $1 you contribute, up to a maximum of $3,000 per year. You must contribute $7,500 each year to receive the full $3,000 match.

- Flexible savings opportunities through pretax, Roth, or after-tax contributions from your salary and/or any variable pay you receive, such as commissions or bonuses.

- Investment options, online tools and resources, and expert advice to help you worry less about getting the most from your savings. To speak with a consultant for a financial wellness checkup, call (800) 603-4015.

- Access to retirement investment professionals who can help set you on the path to reach your savings goals.

- Low fees. Fixed recordkeeping fee of $60 per year ($15 per quarter).

How to Enroll and Manage Your Account

You can enroll in the 401(k) Plan, administered by Fidelity, the Friday after your hire date. The only exception is that, if you were hired on a Thursday or after, you will have to wait until the following Friday. Just log in to Fidelity’s NetBenefits®️ website or call (800) 835-5095 to:

- Select your contributions. Contribute as much as you can to take advantage of the annual match from Synopsys. For the full $3,000 match, you must contribute $7,500 on a pretax or Roth 401(k) basis.

- Designate your beneficiary. This person will take ownership of your account upon your death.

- Set aside all or part of commissions and bonuses. The plan lets you earmark money beyond your regular paycheck contribution—such as commission or bonuses to build your savings faster.

If no action is taken after 60 days from date of hire, new employees will be auto-enrolled into the 401(k) Plan at a 10% pretax savings rate and invested in an age-appropriate target date fund. Auto-enrollment does not apply if you are a rehire.

Ways to Save

The 401(k) Plan offers you different ways to save, depending on your financial circumstances.

Pretax Contributions

Your 401(k) contributions are deducted from your paycheck before federal and state taxes are withheld in applicable states. Your contribution reduces your taxable income, so less comes out of your paycheck in taxes today. Your 401(k) Plan contributions, the Synopsys matching contributions, and any investment earnings are not taxed until you withdraw the money from your account.

You can make contributions on a pretax or Roth basis, or a combination of the two, up to the annual IRS limits below.

| 2024 limits | If you’re 49 or younger | If you’re 50 or older |

|---|---|---|

| Pretax contributions | $23,000* | $23,000* |

| Catch-up contributions | N/A | $7,500* |

* Including any Roth contributions.

Roth Contributions

Unlike pretax contributions, Roth contributions are deducted from your paycheck after taxes are withheld. But when you're eligible to withdraw your money, you don’t pay taxes on your contributions or any investment earnings (if you meet the five-year qualification period). The Synopsys matching contributions are subject to ordinary income tax when you withdraw the money from your account.

You can make contributions on a Roth or pretax basis, or a combination of the two, up to the annual IRS limits below.

| 2024 limits | If you’re 49 or younger | If you’re 50 or older |

|---|---|---|

| Roth contributions | $23,000* | $23,000* |

| Catch-up pretax contributions | N/A | $7,500* |

* Including any pretax contributions.

After-Tax Contributions

In addition to pretax and Roth contribution options, Synopsys allows you to save up to $43,000 on an after-tax basis. Your contributions are deducted from your paycheck after taxes and other deductions are withheld. After-tax contributions aren’t eligible for Synopsys matching contributions. However, you can withdraw your after-tax contributions at any time, paying tax only on any investment earnings.

Or you can convert your after-tax contributions to Roth savings within the Synopsys 401(k) Plan to save even more.

In-Plan Conversion

Converting all or some of your pretax or after-tax savings into Roth savings within the Synopsys 401(k) Plan can help you prepare today for taxes after retirement. Here’s why: You pay federal income tax in the year of conversion, but that’s it. You will not pay taxes on the investment earnings when you withdraw funds later.

Matching Contributions

For every $1 you contribute to your 401(k) savings account, Synopsys will contribute $0.40, up to a maximum of $3,000 per year. To receive the full match, contribute at least $7,500 on a pretax and/or Roth basis each year. This chart shows what you stand to lose if you’re not saving in the 401(k) Plan.

Rollovers

Heads up to new hires: If you have a balance in a former employer’s retirement plan, consider consolidating your accounts by moving your money into the Synopsys 401(k) Plan. It’ll save you the headache of monitoring multiple investment accounts—plus make it easier to manage and diversify your investments. To learn more, visit Fidelity’s NetBenefits website, or speak with a Fidelity representative at (800) 835-5095.

Investment Options

How you invest the money in your 401(k) account is completely up to you. Choose from target date funds that match the year you think you’ll retire, our core portfolio of funds, or even a brokerage account you set up with our administrator, Fidelity. See all your investment options on Fidelity’s NetBenefits website, or speak with a Fidelity representative at (800) 835-5095.

Fidelity

Log in to Fidelity’s NetBenefits website to find a variety of online tools and resources—including contribution, take home pay, and many other calculators—that can help you get the most out of your Synopsys 401(k) Plan.

You can also call (800) 835-5095 for assistance. The Fidelity Benefits Line is open Monday through Friday, from 8:30 a.m. to 8 p.m. Eastern Time (except on all New York Stock Exchange holidays).

Want to get a better grasp on your current financial status and learn how to build for a comfortable future? Use Fidelity's financial wellness tool.

Just spend 10 minutes answering a few simple questions about your monthly spending, debt, investing strategies, savings goals, and other money matters. When you’re done, you’ll instantly receive a helpful personal assessment. You’ll learn what you’re doing well, how you can improve, and where to go to get help in putting your best financial foot forward.

Recordkeeping Fees

As an account holder, you’ll pay a $15 quarterly recordkeeping fee ($60 per year) to Fidelity to administer your 401(k) account. The fee covers such activities as tracking and maintaining all contributions, investment-related transactions, and plan payments. This fee also covers your access to Fidelity’s NetBenefits website, Fidelity service representatives, and other plan-related services.